Our Kam Financial & Realty, Inc. Diaries

Wiki Article

Our Kam Financial & Realty, Inc. Diaries

Table of ContentsMore About Kam Financial & Realty, Inc.Not known Facts About Kam Financial & Realty, Inc.7 Simple Techniques For Kam Financial & Realty, Inc.Some Known Factual Statements About Kam Financial & Realty, Inc. Getting The Kam Financial & Realty, Inc. To WorkSome Known Factual Statements About Kam Financial & Realty, Inc.

When one takes into consideration that mortgage brokers are not required to file SARs, the real volume of home mortgage fraud activity can be much greater. https://pubhtml5.com/homepage/cvmae/. As of early March 2007, the Federal Bureau of Examination (FBI) had 1,036 pending home mortgage scams examinations,4 compared to 818 and 721, specifically, in the 2 previous yearsThe bulk of mortgage fraud comes under 2 broad classifications based on the inspiration behind the fraudulence. typically entails a borrower that will overstate revenue or possession values on his/her monetary declaration to receive a funding to acquire a home (mortgage lenders california). In a lot of these cases, assumptions are that if the earnings does not increase to fulfill the repayment, the home will be cost a benefit from gratitude

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Discussing

The huge bulk of fraud instances are discovered and reported by the establishments themselves. Broker-facilitated fraud can be fraudulence for property, fraud for earnings, or a combination of both.A $165 million area bank chose to go into the home loan financial organization. The financial institution bought a tiny home mortgage company and hired a knowledgeable home mortgage lender to run the operation.

An Unbiased View of Kam Financial & Realty, Inc.

The bank informed its primary government regulatory authority, which then contacted the FDIC due to the prospective influence on the financial institution's financial condition (https://businesslistingplus.com/profile/kamfnnclr1ty/). Additional examination revealed that the broker was working in collusion with a builder and an evaluator to turn buildings over and over once again for greater, illegitimate revenues. In total, greater than 100 financings were originated to one builder in the very same subdivision

The broker rejected to make the repayments, and the instance went into lawsuits. The bank was at some point awarded $3.5 million. In a subsequent discussion with FDIC supervisors, the bank's head of state suggested that he had always heard that one of the most tough component of home mortgage banking was ensuring you applied the ideal hedge to counter any type of rates of interest risk the financial institution could incur while warehousing a significant quantity of home loan loans.

The Ultimate Guide To Kam Financial & Realty, Inc.

The bank had representation and service warranty clauses in contracts with its brokers and assumed it had recourse with respect to the finances being come from and offered with the pipe. Throughout the lawsuits, the third-party broker said that the bank should share some responsibility for this direct exposure due to the fact that its inner control systems should have recognized a finance focus to this set subdivision and set up procedures to hinder this risk.

What we call a regular monthly mortgage repayment isn't just paying off your home mortgage. Instead, assume of a regular monthly home loan payment as the 4 horsemen: Principal, Rate Of Interest, Property Tax Obligation, and House owner's Insurance coverage (called PITIlike pity, because, you know, it raises your payment).

However hang onif you assume principal is the only total up to take into consideration, you 'd be ignoring principal's finest buddy: passion. It 'd behave to assume lenders let you borrow their money just due to the fact that they like you. While that might be real, they're still running an organization and wish to put food on the table also.

Facts About Kam Financial & Realty, Inc. Revealed

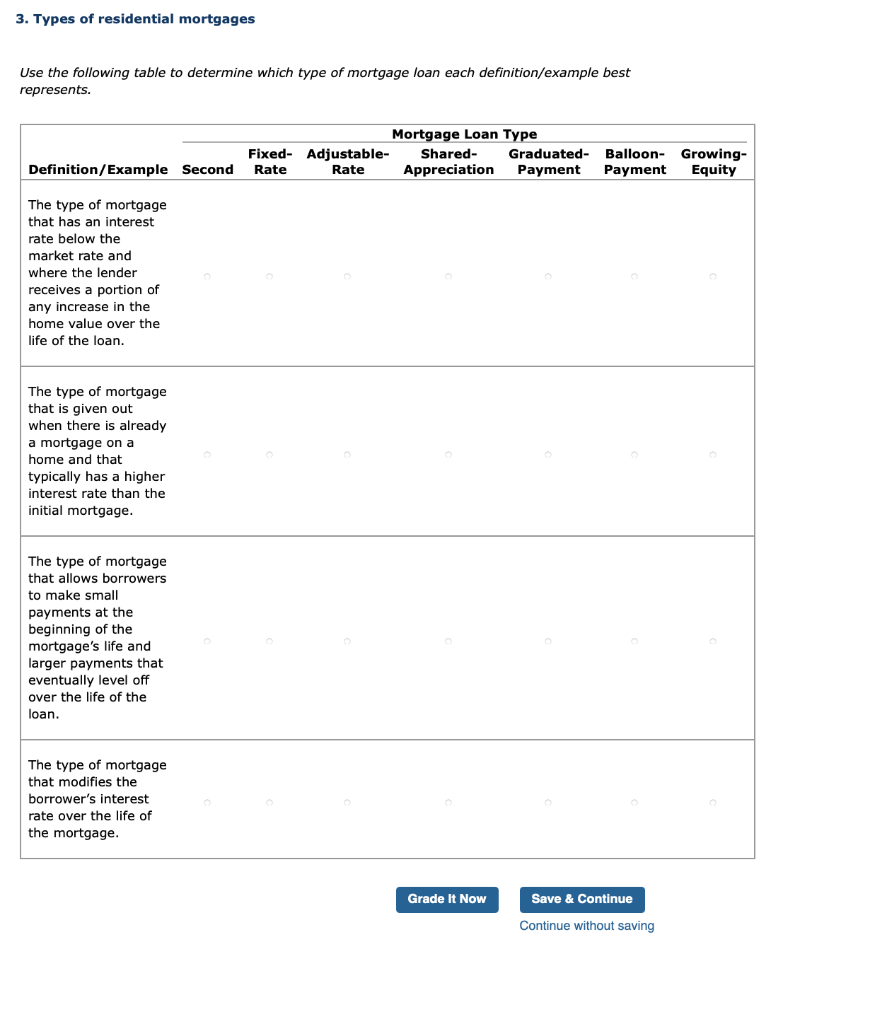

Rate of interest is a percentage of the principalthe quantity of the loan you have actually left to pay back. Rate of interest is a portion of the principalthe amount of the financing you have actually delegated pay back. Home loan rate of interest rates are continuously changing, which is why it's smart to pick a home mortgage with a fixed rate of interest so you understand just how much you'll pay monthly.

That would suggest you would certainly pay a tremendous $533 on your very first month's mortgage repayment. Prepare for a bit of math below. But don't worryit's not difficult! Using our home mortgage calculator with the example of a 15-year fixed-rate mortgage of $160,000 once again, the total passion cost mores than $53,000.

The Greatest Guide To Kam Financial & Realty, Inc.

That would make your month-to-month home loan repayment $1,184 each month. Monthly Principal $1,184 $533 $651 The next month, you'll pay the exact same $1,184, yet less will go to passion ($531) and more will go to your principal ($653). That pattern proceeds over the life of your mortgage till, by the end of your mortgage, almost all of your payment goes toward principal.Report this wiki page